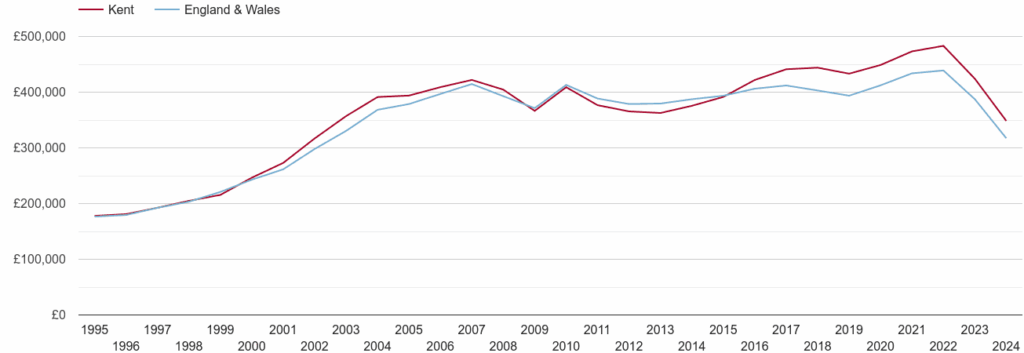

Despite ongoing national political and economic uncertainties, Kent’s property market continues to demonstrate resilience and opportunities for long-term property growth for landlords and investors. A recent analysis published by the National Landlord Investment Show, authored by renowned property expert Kate Faulkner OBE (Property Checklists), highlights the advantages of looking to Kent for long-term growth, making it an attractive region for property investment.

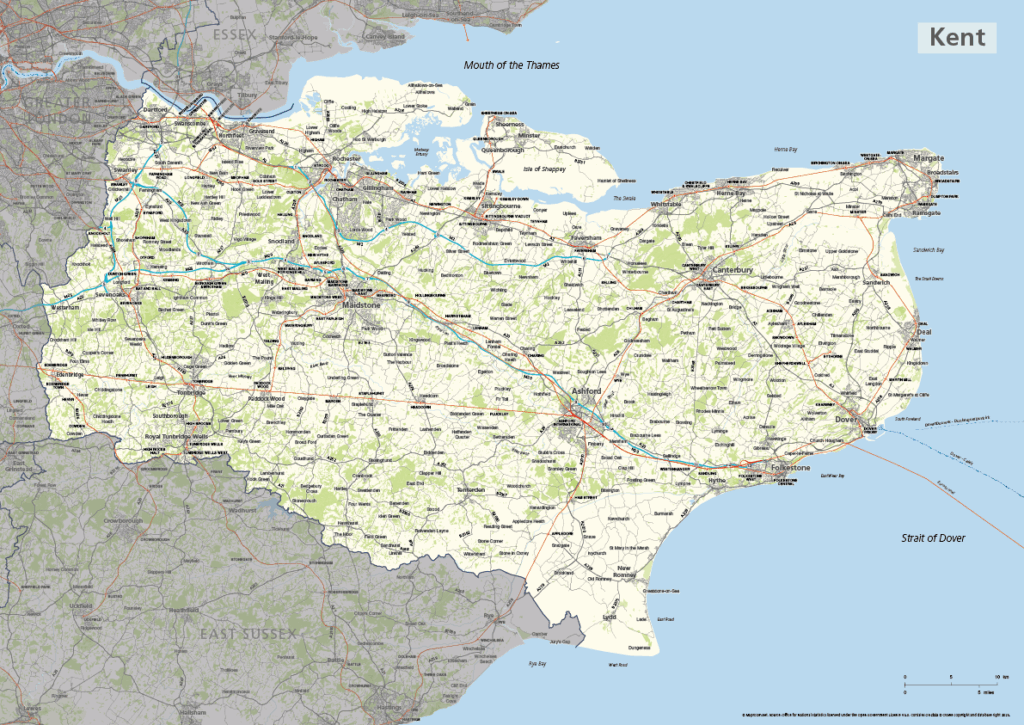

While Kent’s average property prices are higher than the UK and England averages, they remain approximately 10% lower than those in the broader South East region. Although recent annual price growth in Kent stands at around 3.9%, slightly lagging behind the UK average of 4.9%, the county’s historical data suggests that Kent has consistently outperformed national and even regional averages over the long term.

Faulkner’s analysis emphasises the importance of understanding localised data rather than relying solely on broad UK averages and the need to base expectations on post-2005 data. This localised knowledge is essential for making smarter, more strategic property investments.

Kent vs the UK: A Resilient Market in Challenging Times

According to recent data from Rightmove and Zoopla, the average house price in Kent is currently around £422,591, which is 10% below the broader South East average, but significantly higher than the UK average (c. £282,000). Although annual price growth in Kent is slightly behind the national average at around 3.9%, its historical performance consistently outpaces many other regions due to a combination of commuter demand, local economic resilience, and diverse property stock.

Where in Kent Should You Be Looking in 2025?

At Lifeboat Lettings, we work with landlords investing across the county. Based on Zoopla’s area performance reports and rental yield insights, these five towns continue to show promising growth:

🟧 Ashford

A major commuter hub with fast trains to London in under 40 minutes, Ashford has seen consistent demand from young professionals and families. Average property prices remain below the South East average, offering strong capital growth potential.

🟧 Folkestone

Still undervalued compared to nearby coastal towns, Folkestone offers seaside appeal, increasing gentrification, and a thriving arts scene. Yields on HMOs and family lets are particularly attractive.

🟧 Maidstone

As Kent’s county town, Maidstone has a stable rental market with good schools and retail access. It’s popular with families and young couples, making it a consistent performer for single lets.

🟧 Dover

Affordable entry points for new investors. The Dover regeneration plan and improvements to port infrastructure are helping this area gain traction among savvy landlords.

🟧 Medway (Gillingham, Chatham, Rochester)

Medway continues to lead in rental yields, especially in 2-3 bed terraces. With student demand from local universities and good transport links, this is a hotspot for both short- and long-term investment strategies.

How Does Kent Compare to Other Regions?

Kent has held steady over the last 12 months, especially when compared to more volatile areas like the East Midlands and North East. While London remains the highest-priced market, Kent offers better affordability with the bonus of proximity to the capital, which many investors consider the “sweet spot” for long-term growth and tenant demand.

Need Help Staying Compliant?

We understand that for self-managed landlords and growing property investors, the pace of change in legislation can feel overwhelming. That’s why we offer compliance audits, rent reviews, and more to keep you and your investment protected.

Book a call now to find out how we can help

Kent continues to demonstrate strength in both capital growth and rental yield — particularly when you know where to look and how to plan for incoming changes. With strong local economies, transport links, and an adaptive property landscape, Kent is more than just a good place to invest — it’s a smart one.

Ready to Futureproof Your Property Investments?

Let’s talk. Whether you’re already a landlord or just exploring your first buy-to-let in Kent, we’re here to help.

“Don’t wait to buy real estate. Buy real estate and wait.” – Will Rogers